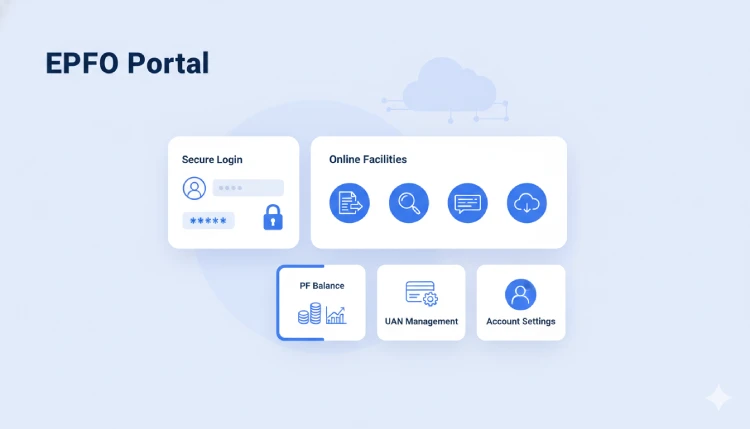

The EPFO Portal plays a central role in managing provident fund services for millions of salaried individuals in India. It brings together employee, employer, and pension-related services on a single digital platform, reducing paperwork and delays. Through this system, users can access account details, submit requests, and track important updates online.

Designed to improve transparency and convenience, the EPFO Portal supports both employees and organizations in handling provident fund responsibilities efficiently. From viewing balances to updating personal information, the platform simplifies processes that once required multiple offline visits. Understanding how it works can help users make better use of their retirement savings.

What is the EPFO Portal?

The EPFO Portal is an official digital platform managed by the Employees’ Provident Fund Organisation. Its primary objective is to provide easy online access to provident fund accounts, pension services, and related compliance features. By centralizing these services, the system ensures accurate record-keeping and faster service delivery.

Whether someone wants to review contribution details or submit a claim, the portal allows most actions to be completed remotely. This has significantly reduced dependency on physical offices while improving accuracy and accountability across the system.

Key Member Services Available Online

Registered members can access a wide range of services through their accounts. These tools are designed to be straightforward and accessible, even for first-time users.

- View personal and employment details linked to the account

- Submit online requests for transfers or withdrawals

- Update nominee and KYC information securely

- Track claim status without visiting an office

These services are commonly accessed after completing EPFO login, which verifies user identity before showing account-related information.

Accessing Account Information and Passbook Details

One of the most used features of the platform is the ability to view contribution records through the EPFO passbook. This digital statement reflects monthly contributions made by both employee and employer, along with interest credited over time.

Members often use this feature to check PF balance and confirm that deposits are being made regularly. Since the information is updated periodically, it serves as a reliable reference for financial planning and employment verification.

Login Options for Employees and Employers

The platform supports multiple access points depending on user type. Employees generally use the EPFO employee login to manage personal accounts, while organizations rely on the EPFO employer login for compliance and contribution filings.

Employers can upload monthly returns, manage employee records, and respond to official notices online. This separation of access ensures data security while allowing each group to perform its required tasks efficiently.

Unified Access Through the EPFO Ecosystem

To streamline services further, the organization introduced the EPFO Unified Portal, which integrates multiple services under one interface. This approach reduces confusion and allows users to move between features without repeated authentication.

Most services are linked to a universal account number, making EPFO UAN login the primary gateway for members. Users can also access services commonly referred to as PF Login, which focuses on provident fund-specific actions such as claims and transfers. For users looking to understand the process better, guidance related to UAN login can help clarify access steps and account activation.

Account Management and Data Accuracy

Keeping personal details accurate is essential for smooth claim processing. The portal allows members to update information such as name, date of birth, and bank details, subject to verification. Errors in these fields can delay settlements, so regular review is recommended.

Employers also play a role by ensuring employee records are correctly maintained. Timely updates and accurate filings help avoid discrepancies and ensure compliance with statutory requirements.

Making the Most of Online Facilities

Digital access has transformed how provident fund services are delivered. Instead of relying on intermediaries or manual forms, users can independently manage their accounts. This transparency empowers employees to stay informed about their savings while enabling employers to meet obligations efficiently.

As the platform continues to evolve, staying familiar with its features ensures smoother interactions and better long-term account management for all stakeholders.

FAQ (Frequently Asked Question)

Q1. What is the EPFO Portal used for?

The EPFO Portal is an online platform that allows employees and employers to manage provident fund services, view contributions, submit claims, and update account details digitally.

Q2. How can an employee check PF balance through the EPFO Portal?

An employee can log in using their UAN credentials and access the passbook section to view monthly contributions, interest details, and the current PF balance online.

Q3. Is UAN mandatory to access EPFO online services?

Yes, the Universal Account Number (UAN) is essential for accessing most EPFO online services, including login, passbook viewing, claims, and account updates.